Creating a 'No Surprises' Patient Financial Experience is Essential Post-COVID

Posted Date: 9/24/2021

By: Candice Powers, MBA, CRCR, CRCA, and Matt Simon

The global health crisis is creating significant roadblocks for providers trying to optimize their revenue cycle. The economic fallout of the pandemic continues to impact millions of Americans. Nearly 17 million Americans have lost employer health insurance. One in three adults are unable to pay their medical bills with the money available to them, while two-thirds of adults with private insurance have received an unexpected medical bill.

The good news is creating a streamlined patient financial experience can significantly boost patient cooperation, satisfaction and quality, improving hospital revenue cycle performance.

Reimagining the Patient Financial Experience

Meeting consumer-driven expectations for healthcare services is not as easy or obvious as it might seem, as patients often have no idea what their expected financial responsibility will be, even after all care has been delivered. They receive a confusing mix of bills and EOBs from multiple entities that are complex and difficult to understand or are surprised by additional bills after believing they have paid their balance. Many do not understand the provider’s collection policies and perceive they are being unreasonably targeted by the collections team.

Addressing these systemic issues requires a holistic strategy — one that focuses externally on changing patient confidence and conversation and internally on changing the organizational culture. Our experience at Mon Health highlights the effectiveness of such an approach.

Genesis of Pre-Access Services at Mon Health

Mon Health, based in West Virginia, is an integrated healthcare delivery system comprised of three hospitals, two affiliate hospitals and over 50 sites of care. In late 2018, we realized we needed to streamline our pre-access services — our authorization process was in disarray, with very few patients pre-registered prior to service and eligibility denials going through the roof.

We immediately began planning to create a patient-centric onboarding process, normalize the front-end patient experience and increase staff quality and productivity. The goal was to treat each patient uniquely based on their financial circumstances and offer complete financial clearance prior to service, including identifying financial assistance for the uninsured and the underinsured. Most importantly, we wanted to achieve all this in an FTE-neutral environment.

The transition to the pre-access service model was a structured process that involved five months of planning, followed by leadership rollout, recruitment and transfers, and staff training spanning a period of four months. We then began a phased roll out of the services beginning with specialty clinics and radiology (October 2019), heart and vascular (January 2020), COVID screening and telehealth scheduling (March–June 2020) and family practice (January 2021).

Pre-Access Service Model: How It Works

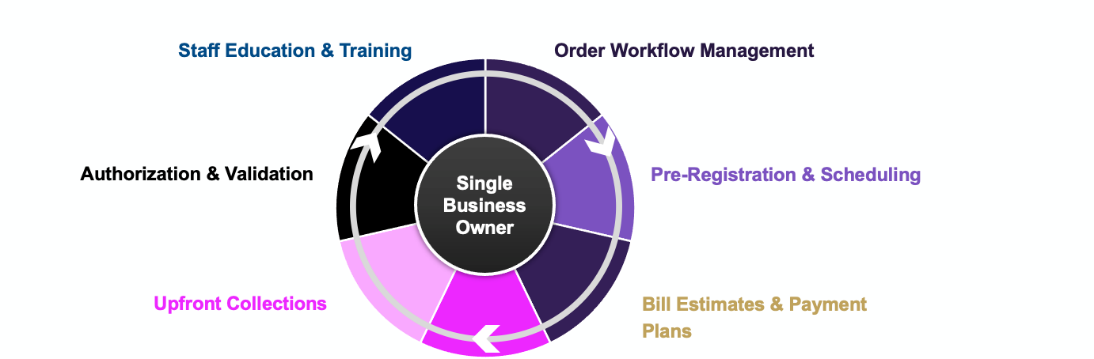

The pre-access service center model encompasses order workflow management, pre-registration, authorization and scheduling (see Figure 1), facilitating “triage and direct” access to care and improving patient satisfaction and collections.

Figure 1: Components of Pre-Access Service Model

Consolidated under a central business owner, it eliminates the pitfalls associated with siloed processes to deliver superior outcomes. The central business owner manages all Patient Access-related activities, sets standards for quality and productivity and identifies future performance opportunities to increase financial clearance beyond set goals.

Building Patient Relationships Prior to Care

The pre-access service center at Mon Health enables our staff to do what’s right for patients and creates access to financial resources early in the patient journey. It helps build relationships that recognize patients as individuals. Here’s how.

It facilitates patient engagement (by phone) at least three days prior to appointment to:

Verify insurance information, deductibles and co-payments

Run bill estimates, assess patient ability to pay

Determine the most appropriate payment options

It also offers free advocacy services that connect patients to public and third-party assistance programs, generates a customized financial care plan and pre-registers patients for all approved services.

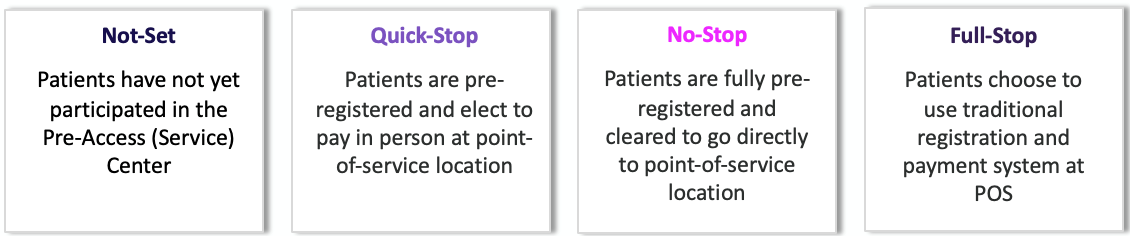

The result: the ability to categorize patients as Not-Set, Quick-Stop, No-Stop or Full-Stop, significantly reducing patient wait times when they arrive at the care facility.

The pre-access service center also plays a pivotal role in ensuring total pricing transparency. It provides a clear understanding of the cost of care prior to scheduled or walk-in services, including pricing information (beyond the change description master) on the website, and enables self-service bill estimates with the ability to reference estimate during scheduling. Where bill estimation is not supported, it helps estimate average cost for common services rendered.

Deploying a Seamless Financial Clearance Process

Accountability is key to ensuring optimal performance. This means not only identifying the right metrics but also consistently measuring and reporting on them. As indicators of the health of your point-of-service collections processes, consider tracking metrics like patient payment status, captured payment opportunities and missed payment opportunities. In addition, ask the following questions to ensure the continued health of POS processes:

What percentage of patient-payment opportunities are captured or missed?

What percentage of patients have paid in full for their obligations prior to service?

What percentage of patients have made partial payments?

What percentage of patients have been put on a payment plan?

What is the patients’ ability to pay across the entire patient population?

As part of your monitoring process, capture and track productivity reports that measure individual and team performance (including daily activity reports showing all transactions for that day), POS collections reports (including missed opportunities) and eligibility reports for both active and inactive eligibility results. Additionally, review denial on trends, patient satisfaction scores and volume/census reports.

While eliminating surprise billing is largely a matter of having the right tools and processes in place, a conducive organizational culture is critical to success — an often overlooked factor. It’s important to ensure that your organization’s culture is equipped to support a shift in the patient financial experience. As with any strategic initiative, when people understand “why” you are driving the pre-access service strategy, your chances of succeeding grow exponentially.

Driving Revenue Cycle Success

Streamlining financial clearance takes the guess work out of the process and gives patients the peace of mind about how they are going to pay for their care. With 35% of provider revenues coming from patients and 75% of patients willing to switch providers for a better healthcare experience, modern hospitals must focus equally on the patient financial experience — and not just the clinical experience — to ensure an exceptional overall experience. Taking a personalized financial approach through a pre-access service center elevates patient conversation and confidence, significantly magnifying impact for patients, providers and the community

Popularity:

This record has been viewed 2555 times.